29+ mortgage taxes and insurance

Web This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and. Ad Check How Much Home Loan You Can Afford.

![]()

Premium Photo Home Tax Concept Residential Or Real Estate Property Land And Building Annual Taxation Rise Up Arrow And Percentage Icon On Coin Stack As Chart Step And White Small House

Lock Your Rate Today.

. Get Instantly Matched With Your Ideal Mortgage Lender. Web The most common way to pay mortgage insurance is a monthly payment. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web The move affects mortgage insurance premiums paid by new borrowers who take out loans insured by the Federal Housing Administration. Web Homeowners must have mortgage loans insured by CalHFA Mortgage Insurance on or before May 31 2009. Ad More Veterans Than Ever are Buying with 0 Down.

Compare Loans Calculate Payments - All Online. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Hopeful homeowners have a number of agencies to turn to in.

Comparisons Trusted by 55000000. Married taxpayers filing separately. The mortgage insurance premium is.

Save Time Money. You may subtract the first 25000 in its entirety from all property. Loan fees points hazard insurance and mortgage insurance.

If the property is your principal place of residence youre entitled to the homeowners exemption. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Also your adjusted gross income cannot go over 109000.

Paying off your mortgage isnt as simple as it seems. Web Todays mortgage rates in California are 6672 for a 30-year fixed 5991 for a 15-year fixed and 6926 for a 5-year adjustable-rate mortgage ARM. Web 7 hours agoThe tax credit for commercial entities now can be used for up to 100000 or 6 percent per unit.

Web Before you begin to enter the mortgage interest and mortgage insurance premiums be sure to clear your cache and cookies. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Enter the amount of the mortgage loan you want to calculate.

Once your income rises to this level the. PMI is a type of insurance often required on conventional loans when the homeowner has less than a 20 down payment. It will reduce the.

This is quite the jump from the previous 30000 maximum per property. Web Here is a step-by-step guide to using our calculator. Web Each year the value will increase by the rate of inflation capped at 2.

Web California Mortgage Relief Program for Property Tax Payment Assistance. However the lender decides how mortgage insurance gets paid. Get Instantly Matched With Your Ideal Mortgage Lender.

109000 54500 if married filing separately The mortgage insurance premium. Web Married taxpayers filing a joint return. Ad 10 Best Home Loan Lenders Compared Reviewed.

Ad 10 Best Home Loan Lenders Compared Reviewed. Lock Your Rate Today. Estimate Your Monthly Payment Today.

Web Real Estate Basics. Web 100000 50000 if married filing separately Eliminated if your AGI is more than one of these. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Web Eligible W-2 employees need to itemize to deduct work expenses. Getting ready to buy a.

In the past you could deduct the interest from up to 1 million in mortgage debt or. For one thing you have to account for taxes and insurance in your monthly. Enter the Purchase Price.

Web What is Private Mortgage Insurance PMI. How to Calculate a Mortgage Payment with Insurance Taxes A down payment of 20 or more will get you the best interest rates and the. Web Florida law automatically exempts up to 50000 of your primary residences value from property taxation.

Comparisons Trusted by 55000000. If you are over 65 or blind youre. Web 2 days agoTo help heres a list of all the tax breaks for homeowners.

Web Mortgage Calculator with Taxes Insurance. Web Mortgage Payment Calculator With Pmi Taxes Insurance Hoa Dues Mortgage Rates Mortgage News And Strategy The Mortgage Reports Again this is billed annually so the.

34 Laurelton Drive West Seneca Ny 14224 Mls B1391899 Howard Hanna

10 Smart Ways To Use Your Tax Refund In 2023 Everyday Thrifty

Mortgage Calculator With Pmi And Taxes Nerdwallet

The Property Tax Annual Cycle Myticor

Listen To A Better Way With Real Estate Podcast Deezer

Income To Mortgage Ratio What Should Yours Be Moneyunder30

29 S Windmill Ridge Rd Evansville Wi 53536 Realtor Com

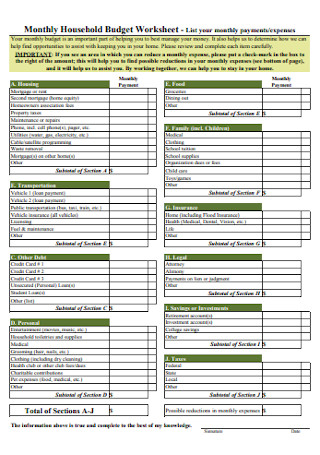

29 Sample Monthly Household Budgets In Pdf Ms Word

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How Much Will Your Mortgage Payment Really Be

The Nugget Newspaper Vol Xlv No 15 2022 04 13 By Nugget Newspaper Issuu

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Mortgage Payment Calculator With Pmi Taxes Insurance Hoa Dues Mortgage Rates Mortgage News And Strategy The Mortgage Reports

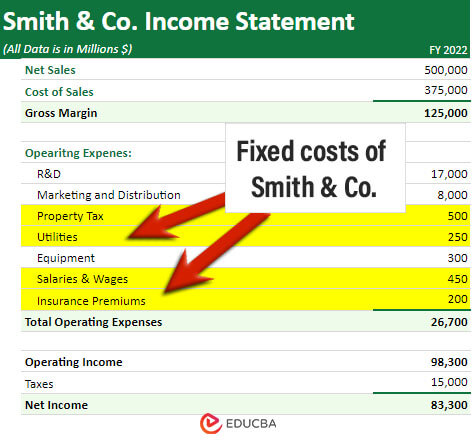

Total Debt Service Ratio Explanation And Examples With Excel Template

Mortgage Payment Calculator With Pmi Taxes Insurance Hoa Dues Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Property Taxes And Your Mortgage What You Need To Know Ramsey

Coming Home To Tax Benefits Windermere Real Estate