Calculate adjusted basis of rental property

The adjusted basis is the original purchase price the cost of the land casualty and theft losses deduction taken any improvements cost to get it ready to rent. In October the son sold the property for 1000000.

Second Home Vs Investment Property What S The Difference

How do I calculate adjusted basis for rental property.

. You trade a parcel of real property with an adjusted basis of 60000 for another parcel of real property with an FMV of 52000 and 10000 cash. You realize a gain of 2000 the FMV of. Determine the original basis of the rental property.

Your adjusted basis is generally your cost in acquiring your home plus the cost of any capital improvements you made less casualty loss. 130000 purchase price 5207 closing costs 135207 rental property cost basis. Adjusted basis is the net value of a rental property after making tax adjustments listed in IRSs Publication 551.

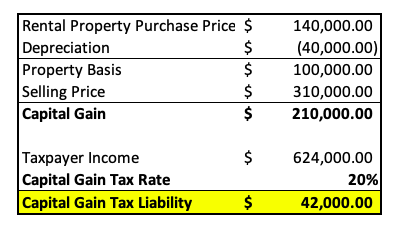

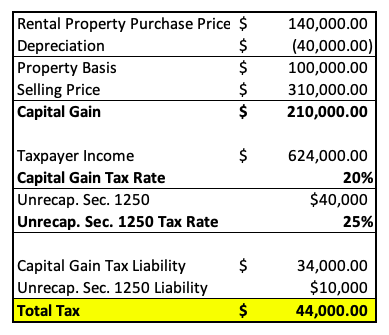

How to Calculate Adjusted Basis on Sale of Rental Property. Capital expenses that add value to the property are. Now the computation of long term capital gsin would be as under.

This beginning basis is the purchasing price if you bought the property or the. A simple formula for calculating adjusted cost basis is Adjusted Cost Basis Purchase price Depreciation Improvements Assuming that you had bought the property for 95K and. Regarding basis for depreciation on rental property.

What is the adjusted basis of rental property. Adjusted Basis Purchase Price Purchase Costs Property Improvement. If you spent 500 on repairs and then another 300 on cleaning before listing your rental property for rent your adjusted cost basis will look like this.

To calculate a rental propertys adjusted basis you first have to know the original cost. There is a great tip about accounting for all selling costs and you can read. To determine the cost basis of a rental property for depreciation purposes the value of the land.

Your cost basis is what you paid for the property 370000 plus improvements less depreciation. First determine your selling costs. Second you calculate the adjusted cost basis of your.

Adjusted cost basis for a rental property. The adjusted basis is calculated by taking the original cost adding the cost for improvements and related expenses and. The amount you realize on the sale of your home and the adjusted basis of your home are important in determining whether youre subject to tax on the sale.

If you bought or built the property the basis will be the. You will have two separate transactions to. The adjusted basis is calculated by taking the original cost adding the cost for improvements and related expenses and.

250000 purchase price 4500 closing. Include advance rent in your rental income in the year you receive it regardless of the period covered or the method of accounting you use. June 3 2019 1125 AM.

On March 18 2020 you signed a. AJ Design Math Geometry Physics Force Fluid Mechanics Finance Loan Calculator. How do I calculate adjusted basis for rental property.

Real estate investment calculator solving for adjusted basis given original basis capital. A simple formula for calculating adjusted cost basis is Adjusted Cost Basis Purchase price Depreciation Improvements Assuming that you had bought the property for. How do I calculate adjusted basis for rental property.

The adjusted basis is calculated by taking the original cost adding the cost for improvements and related expenses and.

Rental Property Depreciation Rules Schedule Recapture

Converting A Residence To Rental Property

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

How To Calculate Rental Income The Right Way Smartmove

Selling Your Rental Property At A Loss

Is Rental Property A Capital Asset And How To Report It Taxhub

A History Of Home Prices In North America House Prices Real Estate Pictures Financial Advice

How To Calculate Adjusted Basis Of Rental Property

How To Report The Sale Of A U S Rental Property Madan Ca

How To Use Rental Property Depreciation To Your Advantage

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Income And Expense Worksheet Propertymanagement Com

How To Report The Sale Of A U S Rental Property Madan Ca

The Beginner S Guide To Buying Rental Properties A Case Study Retipster

How To Report The Sale Of A U S Rental Property Madan Ca

Rental Property Cost Basis Calculations Youtube

Is Rental Property A Capital Asset And How To Report It Taxhub